Financial Stability Report, December 2022

Financial system is stable but its prospects have worsened.

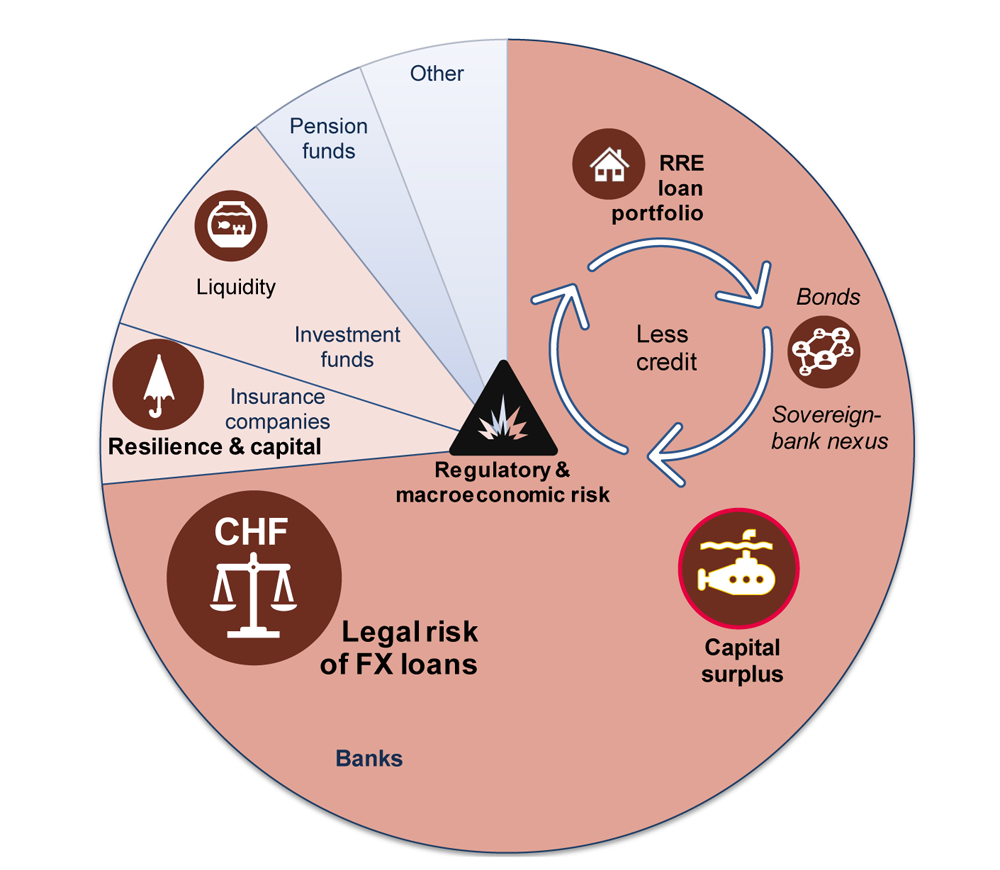

The banking system remains stable but since the release of the last edition of the Report, the overall assessment of domestic financial stability has worsened. This is due to unfavourable macroeconomic, legal and regulatory environment of the banking sector.

A rise in provisions for credit risk and a marked slowdown of lending, especially to the household sector, is expected.

The legal risk of FX housing loans remains the main risk to Poland’s financial stability. However, banks’ remedial actions, including the provisions they have created and the settlement process, increase their resilience to the risk.

The current level of capital held by the banking sector is sufficient to absorb credit losses even when macroeconomic shock scenarios are assumed. The expected decline in excess capital above the combined capital requirements is a new phenomenon in the banking system, which may reduce banks’ propensity and capacity to provide financing to the economy.

Many recent challenges to Poland’s financial system stability stem from the undermining of legal and regulatory solutions or their asymmetric application to various market participants. This especially applies to some aspects of FX housing loans and universal loan holidays offered to zloty loan holders irrespective of their financial standing. Recently, there have been attempts to challenge zloty loan agreements based on the WIBOR rate, which have been in force and remained unchallenged for years. Intensification of these attempts may contribute to undermining confidence in credit contract itself and harm economic growth. Meanwhile, the fact that the Polish Financial Supervision Authority has authorised GPW Benchmark as the administrator of the WIBOR confirms that the methodology of its determination is in accordance with the European regulation and ensures robustness and reliability of the benchmark.

Financial Stability Report, December 2022

Notes: The share of individual sectors (banks, insurance companies, etc.) reflects the value of their assets. The size of the circles describing individual risks depends on the scale of risk (low, medium, high). New risk is outlined in red. The colour of individual sectors reflects the intensity of systemic risk – from very low (blue), through low and moderate, to high (maroon).

In the opinion of NBP, implementation of the following recommendations will be conducive to maintaining the stability of Poland’s financial system.

- Settlements in FX housing loans

Banks and borrowers should continue to reach settlements in FX housing loan cases, thus contributing to accelerating the pace of dispute resolution. - The Minimum Requirement for Own Funds and Eligible Liabilities (MREL)

Banks should step up their action aimed at complying with the MREL timely, seeking to meet the requirement with eligible debt instruments, and not only with capital - Reduction in the risk of moral hazard and the risk of a credit crunch

The aim should be to reduce the uncertainty of the legal and regulatory environment and eliminate incentives to take excessive risk by market participants. Action aimed at the protection and support of financial services consumers should target the financially distressed groups that meet specific conditions. - Coordination of activities within macroprudential policy

The restrictiveness of supervisory and regulatory requirements should take into consideration possible systemic implications and should be coordinated within macroprudential policy. - Consolidation of the cooperative banking sector

It is advisable to continue activities aimed at increasing the degree of integration of the cooperative banking sector and its consolidation. - Insurance companies

When making their solvency assessments, insurance companies should consider the risk of double gearing of capital and the high share of EPIFP in own funds. - Investment funds

Investment funds that redeem participation units on request should reduce the scale of liquidity transformation and increase their liquid asset buffers.